Travel guide to the most famous diamonds in the world.

The summer holidays are just ahead. I hope you have

Have you ever questioned why there are so many cheap diamonds on the market? And how can you almost always find a ‘better’ bargain on the internet? What’s the catch?

Consider you see a diamond offered at an auction, or online, for a very affordable price – let’s dive into this.

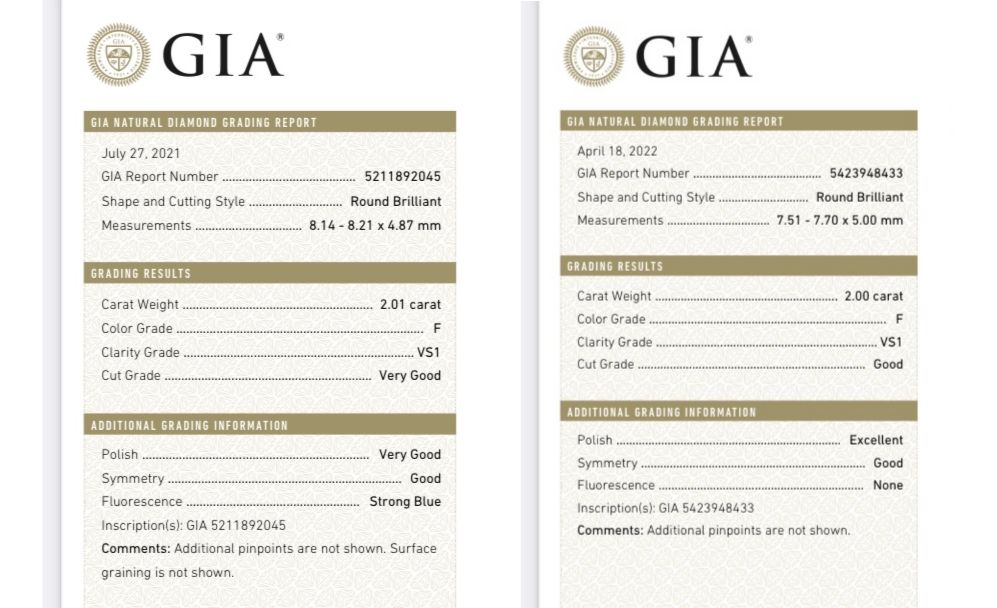

Below are the certificates for a pair of diamonds; each diamond is 2 carats, with a colour F, and with a clarity of VS1. Everything looks perfect, and the seller has them online in an excellent cut, for only 50,000 EUR for the pair.

The answer is no.

First of all, they don’t have the same dimensions. The first diamond is 8.14 mm wide, and the other is 7.51 mm; that’s quite a considerable difference.

Secondly, let’s take a look at the cut grade;

● Cut grade

● Polish

● Symmetry

If you’re looking to buy the perfect diamond, then all aspects have be graded as Excellent. That’s not the case for either of these diamonds – as a result, the diamonds are not cut to perfection and will not shine as much as a diamond of an Excellent grade in all 3 aspects.

In the diamond-trade industry, we call diamonds graded Excellent in all 3 aspects a triple-excellent diamond, or just a triple-ex. These are exactly the diamonds we search for, and they make very good investments.

Lastly, one of the diamonds demonstrates fluorescence (graded as Strong Blue) which essentially means that the diamond lights up strongly in blue under UV light. When searching for investment diamonds, we avoid diamonds that show fluorescence.

This is just one example, next week I will show you some other scenarios.

The summer holidays are just ahead. I hope you have

What is the market for pink diamonds like? And what

An old mine-cut diamond is reminiscent of the past when

Looking for an engagement ring that never goes out of

What is the actual work process of making a custom-made

During the past years, the use of diamonds as an investment and financial hedging tool has grown rapidly.

The reason is obvious: Diamond prices are always increasing. In the last 10-15 years, there’s been a huge interest in investing in colored diamonds, making prices for pink and blue diamonds rise by 400 %.

Read more about Investing in Diamonds

Stay informed about the captivating world of the diamond industry by signing up for our newsletter and receive exclusive insights and updates straight to your inbox.

Østerbrogade 226

Copenhagen Ø

TLF: 53532277

CVR: 40081321

Belgian phone no.: +32 485 00 58 42

Danish phone no.: +45 53 53 22 77

Email: trine@bylamm.com

![]()